Your savings account is not going to fill up overnight, if you want to improve your finances you will have to do your part. Today we bring you 5 steps you can take right now to improve your financial situation and start saving money.

There is no reward without effort, if you do not do your part to improve your financial situation no one will do it for you.

However, starting to manage your money better is not as complicated as it seems; although it requires an initial effort, once you have taken the first steps it will be easy for you to continue on the right path.

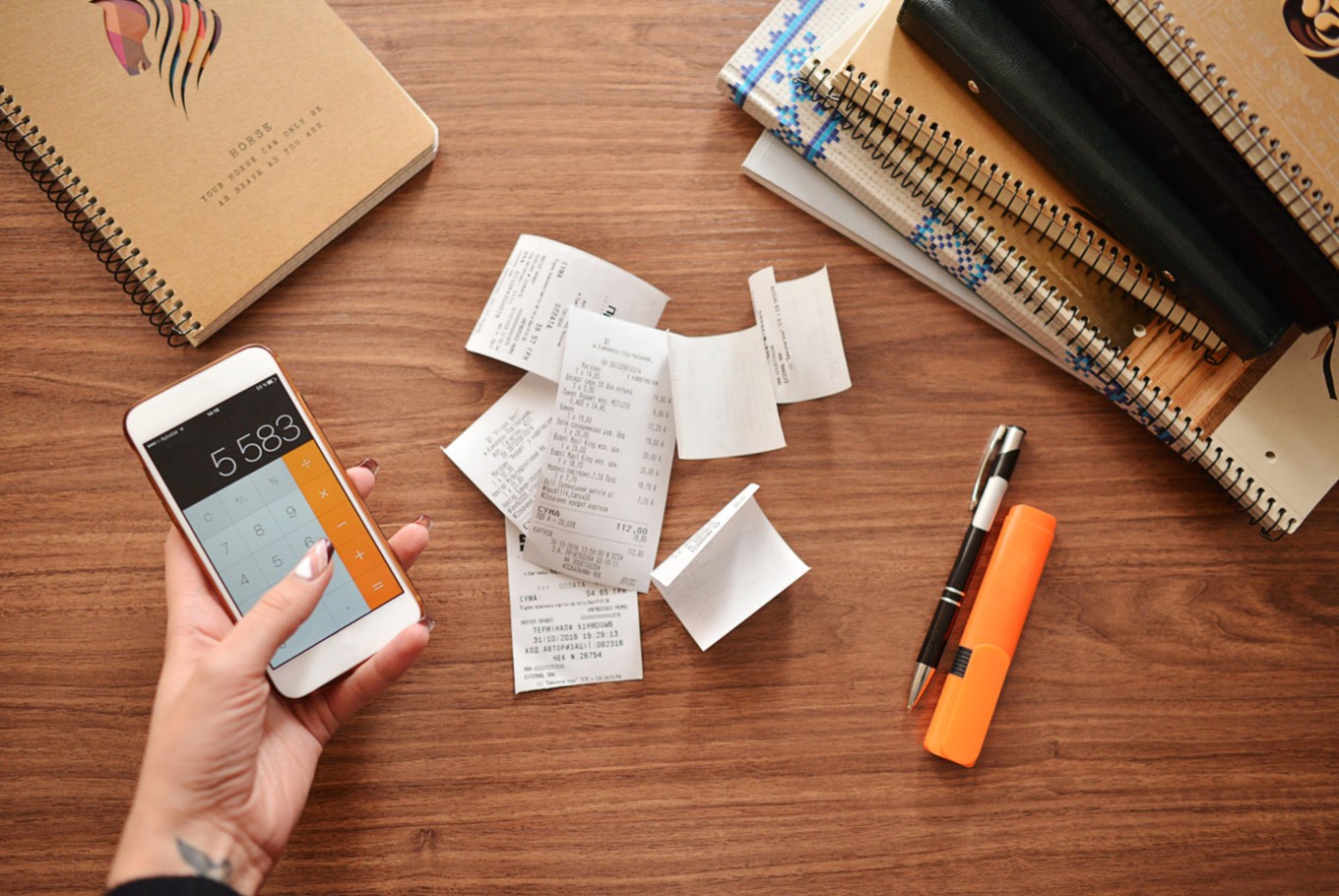

And it is that, when it comes to money, the key is to organize. If we do not have control over our expenses and income, we can hardly use them intelligently.

Today we bring you 5 steps you can take today to improve your financial situation and start saving money …

1) Define your financial goals

First of all you have to know how to answer these questions, why do I want to improve my financial situation? What do I want to do with the money I save? What is my goal? Knowing where you are going will help you move forward along the way. It is important that your objectives are as concrete as possible and, preferably, that they have a time limit. The more progress you see and the closer the final line is, the more motivated you will be. Thus, it is convenient to remember visually what your goal is, putting a photo that reminds you of it in your portfolio or sticking it to the desk.

2) Organize yourself

The more organized you are, the more money you will save. The first thing you should do is to review absolutely all the bills that you have to pay each month and domicile them. If they are automatically charged to you each month, you will not miss any payment and you can live more relaxed. The next step is to see how much money you have in all your accounts. Finally, organize the space in which you live: get rid of everything you do not need and sell it, this method may help you.

3) Make a budget

If you want to start controlling your money you need to know what you spend it on. Keep a record of absolutely everything you buy, however insignificant. Once you are clear about what you spend and enter, it is time to prepare your budget. Plan absolutely all the expenses that you may have, even the unforeseen, and stick to it. In this way you can spend peacefully to the limit of what was planned without feeling bad or worrying constantly.

4) Get more out of your money

It’s time to spend your money on what really matters. Focus on cutting ant expenses, reducing your household bills and canceling all subscriptions that you pay religiously every month but never use. Think about what other things you are wasting your money: maybe you can withdraw money less per month from the cashier and not pay interest, you can possibly save a considerable amount of money in the purchase. It is likely that you will get more money at the end of the month than you think.

5) Check your credit score

This will give you a true reflection of your financial situation. Once you know it, your goal will be to improve it – or keep it in case it’s positive.